1. Introduction

Credit card debt can be overwhelming and stressful, but with the right strategies, you can take control of your financial situation. This guide will provide you with practical tips on managing your credit card debt and regaining financial stability.

2. Understand Your Credit Card Debt

Start by understanding the details of your credit card debt. Take note of the outstanding balances, interest rates, and minimum monthly payments for each card. This knowledge will help you develop a targeted debt management plan.

3. Assess Your Financial Situation

Evaluate your overall financial situation, including your income, expenses, and other debts. Determine how much you can allocate towards debt repayment each month while still covering essential expenses and savings.

4. Create a Budget

Establish a comprehensive budget that outlines your income, expenses, and debt repayment goals. Identify areas where you can cut back on discretionary spending and allocate more funds towards paying off your credit card debt.

5. Prioritize Debt Repayment

Make debt repayment a top priority in your budget. Allocate a portion of your monthly income specifically towards paying off credit card debt. Focus on paying more than the minimum payment to reduce the principal amount and save on interest charges.

6. Explore Debt Repayment Strategies

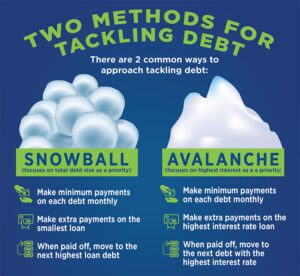

Consider different debt repayment strategies such as the snowball method or avalanche method. The snowball method involves paying off the smallest debt first, while the avalanche method focuses on paying off the debt with the highest interest rate first. Choose the strategy that best suits your financial situation and motivates you to stay on track.

7. Negotiate with Credit Card Companies

Contact your credit card companies to negotiate for lower interest rates or more favorable repayment terms. Explain your financial difficulties and inquire about hardship programs or debt consolidation options. These negotiations can potentially reduce your interest charges and make debt repayment more manageable.

8. Control Your Spending

Rein in your spending habits to avoid accumulating more debt. Stick to your budget, avoid unnecessary purchases, and use cash or debit cards instead of credit cards whenever possible. Practice mindful spending and differentiate between needs and wants.

9. Seek Professional Help if Needed

If your debt burden is substantial or you’re struggling to make progress on your own, consider seeking professional help. Credit counseling agencies or financial advisors can provide guidance, negotiate with creditors on your behalf, and help you develop a personalized debt management plan.

10. Track Your Progress

Monitor your debt repayment progress regularly. Celebrate milestones along the way and stay motivated by visualizing the decreasing balances. Use budgeting apps or spreadsheets to track your payments and monitor your credit score as you make progress towards becoming debt-free.

11. Conclusion

Managing credit card debt requires discipline, determination, and a solid plan. By understanding your debt, creating a budget, prioritizing repayment, exploring strategies, controlling your spending, and seeking help when needed, you can take control of your finances and work towards a debt-free future.

12. FAQs

Q: Should I close my credit card accounts once I pay off the debt?

A: Closing credit card accounts may impact your credit score, especially if they are older accounts. Consider keeping them open and using them responsibly to build positive credit history.

Q: Will negotiating with credit card companies affect my credit score?

A: It’s possible that negotiations may have a temporary impact on your credit score. However, focusing on debt repayment and maintaining timely payments will have a more positive long-term effect on your credit.

Q: Can I still use credit cards while paying off debt?

A: It’s generally advisable to limit credit card usage while paying off debt to avoid adding more to your balances. However, responsible and controlled use of credit cards can help rebuild your credit score and demonstrate responsible financial behavior.

Q: How long will it take to pay off credit card debt?

A: The time to pay off credit card debt depends on several factors, including the total debt amount, interest rates, and the amount you can allocate towards repayment. With consistent efforts and additional payments, you can significantly reduce the debt over time.

Take control of your credit card debt by implementing these strategies and committing to a debt management plan. Remember, being proactive and consistent in your efforts will lead to financial freedom and a brighter future.

Related

The Art of Financial Goal Setting In Audio

1 thought on “Credit Card Debt Management”