1. Introduction

Your credit score plays a crucial role in your financial life, influencing your ability to secure loans, rent an apartment, or obtain favorable interest rates. This guide will provide you with strategies to improve your credit score and enhance your creditworthiness.

2. Understanding Credit Scores

Familiarize yourself with credit scores and their significance. Credit scores are numerical representations of your creditworthiness based on your credit history. The higher your score, the more attractive you appear to lenders.

3. Check Your Credit Reports

Obtain free copies of your credit reports from major credit bureaus (Equifax, Experian, and TransUnion) and review them carefully. Check for errors, inaccuracies, or fraudulent accounts that may be impacting your credit score.

4. Identify and Address Negative Factors

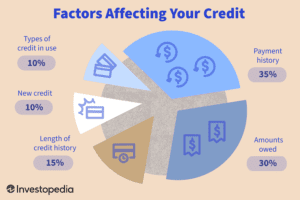

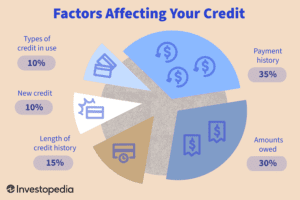

Identify any negative factors affecting your credit score, such as late payments, high credit card balances, or accounts in collections. Address these issues by formulating a plan to rectify them and improve your credit standing.

5. Pay Bills on Time

Consistently paying your bills on time is crucial for maintaining a good credit score. Set up payment reminders, automate payments, or create a budget to ensure timely payments and avoid unnecessary penalties or late fees.

6. Reduce Credit Card Balances

High credit card balances can negatively impact your credit utilization ratio. Aim to keep your credit card balances below 30% of your available credit. Pay down outstanding balances as much as possible to improve your credit score.

7. Limit New Credit Applications

Avoid excessive credit inquiries, as they can lower your credit score. Each new credit application triggers a hard inquiry, which can have a short-term negative impact. Be selective when applying for new credit and only do so when necessary.

8. Diversify Your Credit Mix

Having a mix of credit accounts, such as credit cards, loans, or a mortgage, can positively impact your credit score. Aim for a healthy mix of credit types while ensuring responsible management of each account.

9. Keep Old Accounts Open

Closing old credit accounts may seem like a good idea, but it can negatively affect your credit history and credit utilization ratio. Keep old accounts open, especially if they have a positive payment history, to maintain a longer credit history.

10. Avoid Closing Credit Cards

Closing credit card accounts can increase your credit utilization ratio and reduce your available credit. Instead, consider keeping them open and using them sparingly to maintain a low credit utilization and a positive credit history.

11. Manage Debt Responsibly

Be mindful of your debt and manage it responsibly. Make consistent payments on your loans and credit cards, and avoid maxing out your credit limits. Responsible debt management demonstrates your ability to handle credit effectively.

12. Set up Payment Reminders

Missing payments can significantly impact your credit score. Set up payment reminders through mobile apps, email alerts, or automatic payments to ensure you never miss a payment and maintain a positive credit history.

13. Use Credit Utilization Wisely

Maintain a low credit utilization ratio by using credit cards strategically. Pay off balances in full each month or keep them as low as possible. Responsible credit utilization demonstrates financial discipline and positively affects your credit score.

14. Conclusion

Improving your credit score is a gradual process that requires patience and consistent effort. By implementing the strategies outlined in this guide, you can take control of your credit and work towards a stronger financial future.

15. FAQs

Q: How long does it take to improve a credit score?

A: The time it takes to improve a credit score depends on various factors, including the severity of negative information and the steps taken to rectify it. Generally, significant improvements can be seen within a few months to a year with responsible credit management.

Q: Will checking my credit score affect my score?

A: Checking your own credit score through a soft inquiry does not impact your credit score. It is considered a personal inquiry and has no negative consequences.

Q: Can I improve my credit score quickly?

A: While it may not be possible to improve your credit score overnight, consistent positive actions can lead to gradual improvement over time. Focus on responsible credit management and be patient with the process.

Start taking steps today to improve your credit score and enhance your financial planning. By implementing these strategies and practicing responsible credit management, you can achieve a healthier credit profile and enjoy the benefits of a higher credit score.

Related

Charitable Giving & Tax Benefits