1. Introduction

Dealing with multiple debts can be overwhelming and financially burdensome. Debt consolidation offers a viable solution to simplify your debt repayment and regain control of your finances. This guide will explore different debt consolidation options and help you choose the best strategy for your situation.

2. Understanding Debt Consolidation

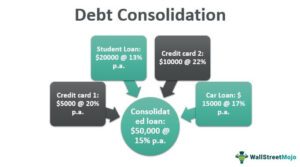

Debt consolidation involves combining multiple debts into a single loan or repayment plan. By consolidating your debts, you streamline your payments and potentially secure a lower interest rate, making it easier to manage your debt.

3. Benefits of Debt Consolidation

Debt consolidation offers several benefits, including:

- Simplified repayment: Instead of making multiple payments to different creditors, you only need to focus on one payment each month.

- Potential interest savings: Consolidating high-interest debts into a lower interest loan can save you money over time.

- Improved cash flow: Lowering your monthly payment through consolidation can free up cash for other essential expenses or savings.

4. Evaluate Your Debt Situation

Assess your current debt situation to determine if debt consolidation is the right option for you. Consider the types of debts you have, the interest rates, monthly payments, and the total amount owed. This evaluation will help you understand the extent of your debt and identify the most suitable consolidation method.

5. Research Debt Consolidation Methods

Explore various debt consolidation methods and understand how they work. Common options include personal loans, balance transfer credit cards, home equity loans or lines of credit, and debt management programs. Each method has its own requirements, benefits, and considerations.

6. Personal Loans

Personal loans are a popular choice for debt consolidation. They involve borrowing a lump sum from a lender and using it to pay off your existing debts. Personal loans typically have fixed interest rates and a set repayment term, making it easier to budget your monthly payments.

7. Balance Transfer Credit Cards

Balance transfer credit cards allow you to transfer existing credit card balances onto a new card with a lower or 0% introductory interest rate. This option can be advantageous if you have high-interest credit card debt and can pay off the balance within the promotional period.

8. Home Equity Loans or Lines of Credit

If you own a home and have built up equity, you may consider a home equity loan or a home equity line of credit (HELOC) to consolidate your debts. These options utilize the equity in your home as collateral, potentially offering lower interest rates. However, they also involve the risk of putting your home at stake.

9. Debt Management Programs

Debt management programs (DMPs) involve working with a credit counseling agency to consolidate your debts into a single monthly payment. The agency negotiates with your creditors for potential interest rate reductions and waived fees. DMPs can provide structure and guidance for managing your debt.

10. Considerations and Risks

Before choosing a debt consolidation method, carefully consider the associated risks and potential drawbacks. Evaluate the impact on your credit score, the total cost of consolidation, and any fees or penalties involved. It’s essential to choose a method that aligns with your financial goals and capabilities.

11. Create a Repayment Plan

Once you’ve selected a debt consolidation method, create a comprehensive repayment plan. Determine a realistic budget, set specific goals, and commit to making timely payments. Avoid taking on new debts and focus on reducing your overall debt load.

12. Seek Professional Advice

If you’re unsure about the best debt consolidation option for your situation, consider seeking advice from a financial professional or credit counselor. They can assess your financial circumstances, provide personalized recommendations, and guide you through the consolidation process.

13. Conclusion

Debt consolidation can be an effective strategy to simplify your debt and regain control of your finances. By understanding your options, evaluating your situation, and creating a solid repayment plan, you can move towards a debt-free future and achieve greater financial stability.

14. FAQs

Q: Will debt consolidation affect my credit score?

A: Debt consolidation itself does not directly impact your credit score. However, certain methods like applying for a new loan or credit card may result in a temporary dip in your score. It’s important to manage your consolidated debts responsibly to maintain or improve your credit over time.

Q: Is debt consolidation suitable for everyone?

A: Debt consolidation is not a one-size-fits-all solution. It depends on your unique financial situation and goals. It’s crucial to evaluate your debts, research the available options, and choose the method that aligns with your needs and ability to repay.

Q: Can I consolidate both secured and unsecured debts?

A: Yes, it’s possible to consolidate both secured debts (e.g., home loans) and unsecured debts (e.g., credit cards, personal loans). The specific consolidation method will depend on the types of debts you have and the options available to you.

Take control of your debt by exploring debt consolidation options and implementing a strategic plan. By consolidating your debts, you can simplify your financial obligations and work towards a brighter financial future.

Have you ever considered about adding a little bit more than just your articles? I mean, what you say is important and all. However imagine if you added some great pictures or video clips to give your posts more, “pop”! Your content is excellent but with images and clips, this site could definitely be one of the very best in its niche. Very good blog!

Thank you for sharing excellent informations. Your web-site is so cool. I’m impressed by the details that you have on this site. It reveals how nicely you perceive this subject. Bookmarked this web page, will come back for extra articles. You, my friend, ROCK! I found just the information I already searched all over the place and simply couldn’t come across. What a perfect web-site.

It抯 onerous to seek out educated individuals on this matter, but you sound like you recognize what you抮e speaking about! Thanks

I enjoy what you guys are up too. This type of clever work and

reporting! Keep up the amazing works guys I’ve added you guys to blogroll.

Its such as you learn my mind! You seem to understand

so much about this, such as you wrote the guide in it or something.

I feel that you just can do with a few p.c. to power the message home a

little bit, but instead of that, this is excellent blog.

A fantastic read. I will definitely be back.

I really like your blog.. very nice colors & theme. Did you create this website yourself or

did you hire someone to do it for you? Plz answer

back as I’m looking to design my own blog and would like to find out where u got this from.

kudos