1. Introduction

Having an emergency fund is crucial for financial stability. It provides a safety net to cover unexpected expenses and protects you from falling into debt. This guide will walk you through the steps to build an emergency fund and achieve greater peace of mind.

2. Assess the Importance of an Emergency Fund

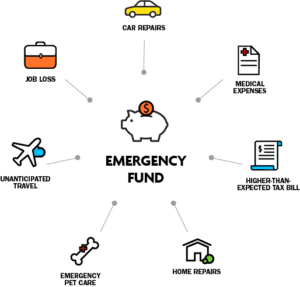

Recognize the importance of an emergency fund in providing financial security. It serves as a buffer during unforeseen circumstances such as job loss, medical emergencies, or major car repairs. Building an emergency fund is a proactive step towards financial resilience.

3. Determine Your Financial Goal

Evaluate your financial situation and determine how much you need to save in your emergency fund. Aim to save three to six months’ worth of living expenses, but adjust this target based on your individual circumstances, such as job stability, dependents, and health concerns.

4. Calculate Your Monthly Expenses

Review your monthly expenses, including essential costs like rent/mortgage, utilities, groceries, transportation, and debt payments. Be thorough and include any recurring or predictable expenses to accurately gauge your financial needs.

5. Set a Realistic Savings Target

Based on your monthly expenses, calculate the total amount needed for your emergency fund. Divide this by the desired timeframe to determine how much you should save each month. Setting a realistic savings target will help you stay motivated and on track.

6. Create a Budget

Develop a comprehensive budget that aligns with your savings goal. Track your income and expenses to identify areas where you can cut back and allocate more towards savings. Consider using budgeting apps or spreadsheets to simplify the process.

7. Reduce Unnecessary Expenses

Review your budget for discretionary spending that can be reduced or eliminated. Cut back on non-essential items like dining out, entertainment subscriptions, or impulse purchases. Redirect those funds towards your emergency fund.

8. Increase Your Income

Explore opportunities to increase your income, such as taking on a side gig, freelancing, or seeking a higher-paying job. The extra income can accelerate your savings growth and expedite the process of building your emergency fund.

9. Automate Your Savings

Make saving effortless by automating regular transfers from your checking account to a dedicated emergency fund. Set up automatic transfers on payday to ensure consistent contributions without the need for constant manual intervention.

10. Consider High-Yield Savings Accounts

Place your emergency fund in a high-yield savings account. These accounts offer competitive interest rates, allowing your savings to grow faster. Research different financial institutions and compare interest rates and terms to find the best option for your needs.

11. Minimize Risk and Access

Balance accessibility with minimizing risk. While you want your emergency fund to be easily accessible, consider keeping it separate from your everyday checking account to avoid impulsive spending. Choose accounts that offer convenient access without penalties or excessive withdrawal restrictions.

12. Stay Committed to Regular Contributions

Maintain discipline and stick to your savings plan. Treat your emergency fund contributions as non-negotiable expenses, just like your rent or mortgage payment. Consistent contributions will help you reach your savings goal faster.

13. Use Windfalls and Bonuses Wisely

Make the most of unexpected windfalls, such as tax refunds, work bonuses, or monetary gifts. Instead of splurging on unnecessary purchases, allocate a portion or all of these windfalls towards your emergency fund to accelerate its growth.

14. Avoid Temptations and Impulsive Spending

Stay focused on your financial goals and resist the urge to divert funds from your emergency savings for non-emergency purposes. Remind yourself of the importance of having a secure financial cushion and the peace of mind it brings.

15. Review and Adjust Your Savings Plan

Regularly review your budget, expenses, and savings progress. As your financial situation evolves, adjust your savings plan accordingly. Reassess your savings target, consider increasing contributions, or redirecting funds as needed.

16. Conclusion

Building an emergency fund requires commitment and discipline, but the peace of mind it provides is invaluable. By following these steps and staying focused on your financial goals, you’ll be well on your way to creating a robust emergency fund.

17. FAQs

Q: How long does it take to build an emergency fund?

A: The time it takes to build an emergency fund varies based on individual circumstances and savings capacity. With consistent contributions, it’s possible to build a fund within several months to a few years.

Q: Should I use credit cards as an emergency fund?

A: It’s not advisable to rely solely on credit cards for emergencies, as it can lead to high-interest debt. An emergency fund provides immediate access to cash without incurring interest charges or debt accumulation.

Q: Can I start an emergency fund with a small amount of money?

A: Yes, even small contributions can add up over time. Start with what you can afford and gradually increase your savings as your financial situation improves.

Take the first step towards financial security by building an emergency fund. With careful planning, budgeting, and consistent contributions, you’ll be prepared for unexpected expenses and better equipped to handle life’s uncertainties.

1 thought on “How to Build an Emergency Fund: A Step-by-Step Guide”