1. Introduction

Planning for retirement involves making sound investment decisions that can provide financial security during your golden years. This guide offers strategies to help you navigate the investment landscape and maximize your retirement savings.

2. Assess Your Retirement Goals

Start by assessing your retirement goals and estimating the amount of money you’ll need. Consider factors such as lifestyle expectations, healthcare costs, and desired retirement age. This assessment will help guide your investment strategy.

3. Understand Risk and Reward

Understand that investing involves risk, and different investment options offer varying levels of potential reward. Determine your risk tolerance and align your investment choices accordingly. A balance between risk and reward is crucial for long-term growth.

4. Diversify Your Portfolio

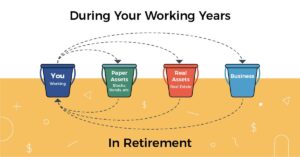

Diversification is key to managing risk in your investment portfolio. Spread your investments across different asset classes, such as stocks, bonds, real estate, and international investments. Diversification helps reduce the impact of market volatility on your portfolio.

5. Allocate Assets Based on Time Horizon

Consider your time horizon when allocating assets. As retirement approaches, gradually shift your portfolio to a more conservative mix to protect against market downturns. Early on, you can afford to take on more growth-oriented investments.

6. Consider Tax-Efficient Investments

Explore tax-efficient investment options, such as tax-advantaged retirement accounts like IRAs and 401(k)s. Take advantage of tax benefits and consider the tax implications of different investment vehicles. Consult a tax professional for personalized advice.

7. Regularly Review and Rebalance Your Portfolio

Regularly review your investment portfolio to ensure it remains aligned with your goals and risk tolerance. Rebalance your portfolio periodically to maintain the desired asset allocation. This helps manage risk and ensures your investments stay on track.

8. Stay Invested for the Long Term

Avoid making hasty investment decisions based on short-term market fluctuations. Stay focused on your long-term goals and avoid emotional reactions to market volatility. History has shown that staying invested and weathering market cycles can lead to favorable returns.

9. Maximize Retirement Account Contributions

Maximize contributions to your retirement accounts, such as employer-sponsored plans and IRAs. Take advantage of employer matching contributions when available. These accounts provide tax advantages and allow your investments to grow tax-free or tax-deferred.

10. Seek Professional Financial Advice

Consider seeking professional financial advice from a certified financial planner or investment advisor. They can help tailor an investment strategy that aligns with your goals, risk tolerance, and time horizon. A professional can provide valuable insights and guidance.

11. Manage Expenses and Minimize Fees

Manage investment expenses and minimize fees. High fees can eat into your investment returns over time. Compare expense ratios and seek low-cost investment options, such as index funds or exchange-traded funds (ETFs), to keep costs in check.

12. Evaluate Social Security and Pension Benefits

Understand your potential Social Security benefits and any pension benefits you may be eligible for. Factor these into your retirement income plan and consider the optimal age to start receiving benefits based on your personal circumstances.

13. Plan for Healthcare Costs

Plan for healthcare costs in retirement, including insurance premiums, deductibles, and potential long-term care expenses. Consider health savings accounts (HSAs) and long-term care insurance options to help manage these costs.

14. Monitor and Adjust Your Strategy

Regularly monitor your investment performance and reassess your strategy as needed. Life circumstances and market conditions change over time, so be prepared to adjust your investment strategy to stay on track towards your retirement goals.

15. Conclusion

Implementing sound investment strategies is crucial for securing your financial future in retirement. By assessing your goals, diversifying your portfolio, and staying informed, you can navigate the investment landscape with confidence.

16. FAQs

Q: How much should I save for retirement?

A: The amount you should save for retirement depends on factors such as your desired lifestyle, expected expenses, and retirement age. Use retirement calculators or consult a financial advisor to determine an appropriate savings target.

Q: What if I haven’t started saving for retirement yet?

A: It’s never too late to start saving for retirement. Assess your current financial situation, create a budget, and begin contributing to retirement accounts as soon as possible. Even small contributions can grow over time with the power of compounding.

Q: Should I consider alternative investments for retirement?

A: Alternative investments, such as real estate or private equity, can offer diversification and potential higher returns. However, they often come with higher risk and may require a deeper understanding. Consult a financial professional to evaluate if they align with your goals and risk tolerance.

Start implementing these investment strategies to secure your financial future in retirement. By making informed decisions, managing risk, and staying focused on your goals, you can build a strong foundation for a comfortable retirement.