Investing involves taking on a certain level of risk, and understanding your risk tolerance is crucial for making informed investment decisions. This risk tolerance assessment will help you evaluate your comfort level with different types of investment risks and guide you towards investment strategies that align with your preferences.

1. Introduction

When it comes to investing, understanding your risk tolerance is essential. It refers to your ability to withstand potential losses and your comfort level with different types of investment risks. This assessment will help you evaluate your risk tolerance and make informed investment decisions.

2. What is Risk Tolerance?

Risk tolerance is an individual’s willingness and ability to take on risk when investing. It varies from person to person and is influenced by various factors, including financial goals, time horizon, financial knowledge, emotional resilience, and capacity for loss.

3. Factors Influencing Risk Tolerance

Financial Goals

Your financial goals play a significant role in determining your risk tolerance. If you have long-term goals and can withstand short-term fluctuations, you may have a higher risk tolerance. On the other hand, if you have short-term goals or a low tolerance for volatility, your risk tolerance may be lower.

Time Horizon

The time horizon for your investments also affects your risk tolerance. Longer time horizons allow for more potential recovery from market downturns, making higher-risk investments more viable. Conversely, if you have a shorter time horizon, such as retirement approaching soon, you may prefer lower-risk investments to preserve capital.

Financial Knowledge and Experience

Your level of financial knowledge and experience can influence your risk tolerance. Those with a good understanding of investment concepts and experience in managing risk may be more comfortable with higher-risk investments. Conversely, individuals with limited knowledge or experience may prefer lower-risk options.

Emotional Resilience

Emotional resilience refers to your ability to handle market volatility and investment fluctuations without making impulsive decisions. If you can remain calm during market downturns and stick to your long-term investment strategy, you may have a higher risk tolerance. However, if you tend to panic or feel anxious about market fluctuations, your risk tolerance may be lower.

Capacity for Loss

Your capacity for loss is the amount of financial loss you can afford without compromising your financial well-being or specific obligations. Factors such as income stability, existing financial commitments, and overall financial health determine your capacity for loss. Those with a higher capacity for loss may have a higher risk tolerance, while those with limited financial flexibility may prefer lower-risk investments.

4. Risk Tolerance Questionnaire

To assess your risk tolerance, consider the following aspects:

Assessment of Financial Goals

Evaluate your financial goals, both short-term and long-term. Consider the importance of preserving capital versus achieving higher returns.

Evaluation of Time Horizon

Determine your investment time horizon for each goal. Longer time horizons may allow for greater risk-taking.

Analysis of Risk Preferences

Consider how comfortable you are with potential investment losses and volatility. Assess whether you prefer steady and conservative returns or are open to greater fluctuations for potentially higher returns.

Consideration of Emotional Resilience

Reflect on how well you handle market fluctuations and whether you tend to make impulsive investment decisions based on emotions.

Examination of Capacity for Loss

Evaluate your financial situation, including income stability, expenses, and obligations. Assess how much financial loss you can tolerate without significant hardship.

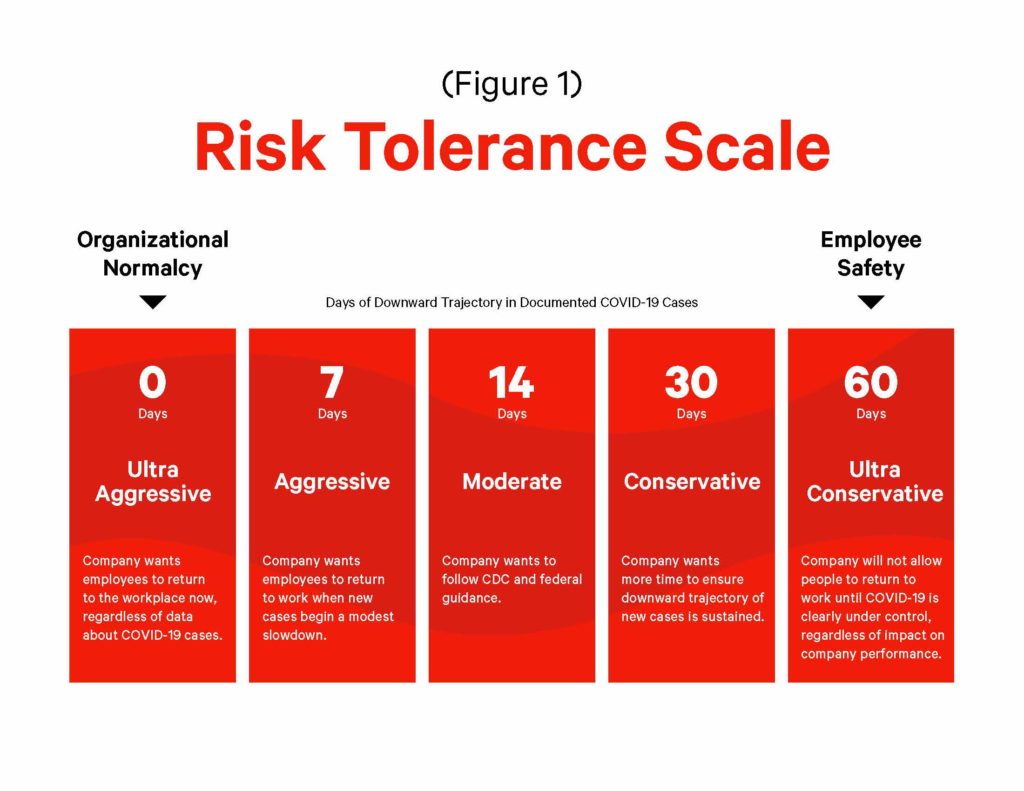

5. Interpreting Your Risk Tolerance

Based on your responses, you can determine your risk tolerance level:

Conservative Risk Tolerance

If you prefer lower-risk investments and prioritize capital preservation over higher returns, you have a conservative risk tolerance. You are more comfortable with stable, low-volatility investments.

Moderate Risk Tolerance

A moderate risk tolerance means you are willing to take on some level of risk for potential higher returns. You are comfortable with a balanced mix of low to moderate-risk investments.

Aggressive Risk Tolerance

An aggressive risk tolerance indicates a willingness to take on significant risk for the potential of higher returns. You are comfortable with high-risk investments and can withstand significant fluctuations.

6. Aligning Risk Tolerance with Investment Strategies

Once you understand your risk tolerance, it’s important to align it with appropriate investment strategies:

Conservative Investment Strategies

For conservative risk tolerance, consider investments with lower volatility, such as bonds, cash equivalents, and stable dividend-paying stocks. Focus on capital preservation and consistent income generation.

Balanced Investment Strategies

Moderate risk tolerance allows for a balanced approach. Consider a diversified portfolio with a mix of stocks, bonds, and other assets. This balance between risk and stability aims for moderate growth while managing potential volatility.

Aggressive Investment Strategies

With aggressive risk tolerance, you may consider higher-risk investments such as growth stocks, small-cap stocks, or alternative investments. These strategies have the potential for higher returns but come with increased volatility.

7. Reassessing Risk Tolerance Over Time

Your risk tolerance may change over time due to various factors like changes in financial circumstances, personal goals, or market conditions. It’s important to reassess your risk tolerance periodically and adjust your investment strategy accordingly.

8. Conclusion

Understanding your risk tolerance is crucial for successful investing. By assessing your financial goals, time horizon, knowledge, emotional resilience, and capacity for loss, you can align your investment strategy with your risk comfort level. Regularly review your risk tolerance to ensure your investments remain in line with your evolving circumstances and goals.

9. FAQs

What if my risk tolerance changes?

Your risk tolerance can change over time. Keep reassessing it whenever significant life events occur or when your financial goals or circumstances shift. Adjust your investments accordingly to maintain alignment.

Can I have different risk tolerances for different investment goals?

Yes, it’s possible to have different risk tolerances for different investment goals. You may be more conservative with short-term goals and more aggressive with long-term goals. Tailor your investment strategies to each specific goal.

Should I always invest according to my risk tolerance?

Investing according to your risk tolerance is generally advisable. However, consider seeking professional financial advice to ensure your investment choices align with your risk tolerance and financial goals.

10. Related

Saving Strategies for Future Expenses: A Comprehensive Guide

2 thoughts on “Risk Tolerance Assessment: Understanding Your Investment Comfort Level”